CBRE recently released its 2019 multifamily inbound investment trends. Several things in the findings were noteworthy and provide confirmation that at CGI Strategies we are continually staying with the trends and building a foundation to withstand even the most volatile of markets that could lie ahead.

Multifamily Investment Trends

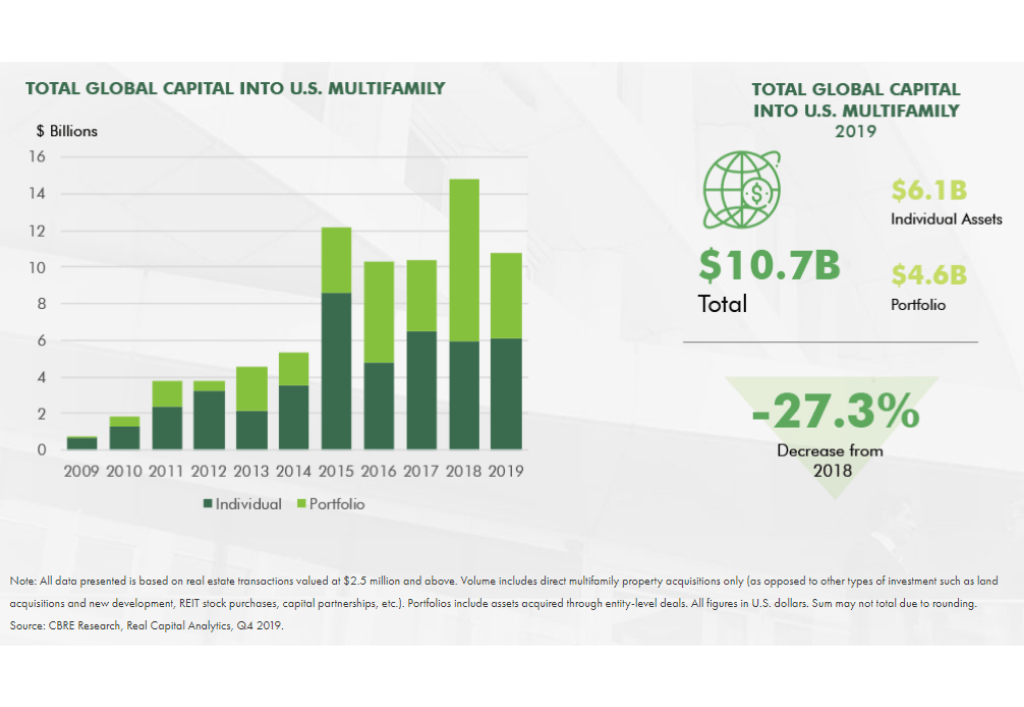

While global capital in the U.S. multifamily sector decreased overall in 2019 (27.3%), single asset deals actually increased inbound capital by 3.8% – up to $6.1B.

Global investors are interested in large assets – almost half of multifamily assets were priced at over $200M last year.

Of greatest note are the highest performing multifamily markets. The highest performer by far is the Orlando area, which added a gain of 231%. Other key areas – Atlanta and Los Angeles, ended with gains of over a half a billion respectively.

Why Does That Matter?

Those areas are of primary focus at CGI. No matter what happens in 2020, we will continue to stay ahead of trends to make the best of each dollar invested.

Want to learn more about multifamily investing with CGI Strategies? Contact us today.