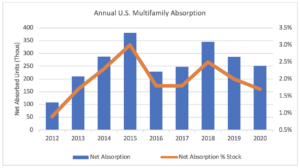

Demand for multifamily took a hit in the early stages of the COVID-19 pandemic but – thanks to a strong bounce back in the second half of 2020 — absorption for the full year was robust overall. All told, 252,000 apartment units, or 1.7% of total stock, were absorbed in the U.S. in 2020, according to Yardi Matrix.

The number of units absorbed in 2020 was only 12% less than the 286,300 units absorbed the prior year, and not too far from the average during the last cycle. Absorption (the change in net units occupied) accelerated to 160,400 in the second half of 2020, up 75% from the first half of 2020. Considering the economic and social calamity that befell the U.S. in many respects due to COVID-19, that demand held up as well as it did is a relief for the apartment industry.

The number of units absorbed in 2020 was only 12% less than the 286,300 units absorbed the prior year, and not too far from the average during the last cycle. Absorption (the change in net units occupied) accelerated to 160,400 in the second half of 2020, up 75% from the first half of 2020. Considering the economic and social calamity that befell the U.S. in many respects due to COVID-19, that demand held up as well as it did is a relief for the apartment industry.

Among the biggest effects of COVID-19 on multifamily were the loss of millions of service jobs and the work-from-home trend that let urban offices empty. The U.S. had nearly 10 million fewer jobs in February 2021 than a year earlier. Large employment centers also lost the typical inflow of new workers, such as college graduates starting careers in professional offices.

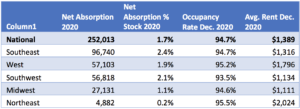

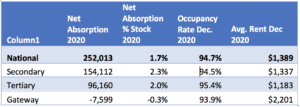

Demand was not evenly spread. Renters flocked to the Southeast (96,700 units absorbed, or 2.4%), the Southwest (56,800 units, 2.1%), and the West (57,100 units, 1.9%). The Midwest (27,100 units, 1.1%) and the Northeast (4,900 units, 0.2%) struggled.

Dallas, Atlanta, Denver, and Phoenix were the top metros, accounting for more than 53,000 units absorbed. New York (-18,600) was the biggest loser, while Chicago (-2,800) and San Francisco (-2,700) also were negative. Major Southern California metros – Inland Empire (5,700, 3.7%), San Diego (4,200, 2.2%) and Los Angeles (3,100, 0.7%) – were all positive.

The signs are encouraging going forward. The availability of COVID-19 vaccines makes it likely that normal activity might be possible by the end of 2021, or maybe in 2022. When downtown office buildings and urban entertainment venues re-open, some of those who left are sure to return to return. Whatever “normal” means post-COVID-19, it could be on its way before too long.

- Paul Fiorilla, Director of Research, Yardi matrix