The real estate market is currently facing a period of uncertainty due to the economic impacts of the COVID-19 pandemic. Investors are worried about the potential for a prolonged recession, which could lead to a decrease in property values and a decrease in rental income. The uncertainty surrounding the future of the economy has caused investors to become more cautious about investing in real estate.

The real estate market is currently facing a period of uncertainty due to the economic impacts of the COVID-19 pandemic. Investors are worried about the potential for a prolonged recession, which could lead to a decrease in property values and a decrease in rental income. The uncertainty surrounding the future of the economy has caused investors to become more cautious about investing in real estate.

There are a few things that can reverse a downward trend very rapidly. These include a combination of government intervention, increased consumer confidence, and improved economic conditions. Government intervention usually includes tax incentives for developers, increased access to credit, and increased investment in infrastructure. With the passing of the Inflation Reduction Act, state and local governments are under pressure to increase spending on energy-efficient projects that will reduce each state’s overall carbon output.

Increased consumer confidence is achieved through improved job security, increased wages, and rental vacancy and stability. Spending by consumers, as well as domestic and foreign capital investments, will improve economic conditions.

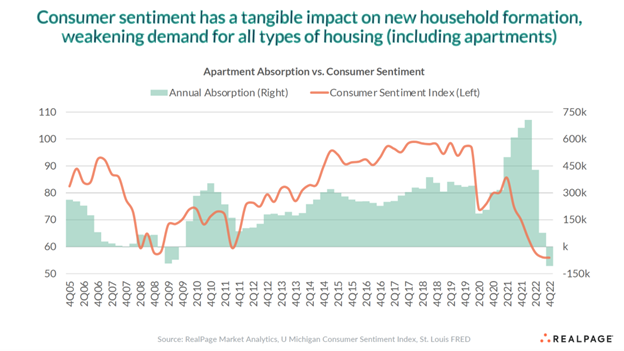

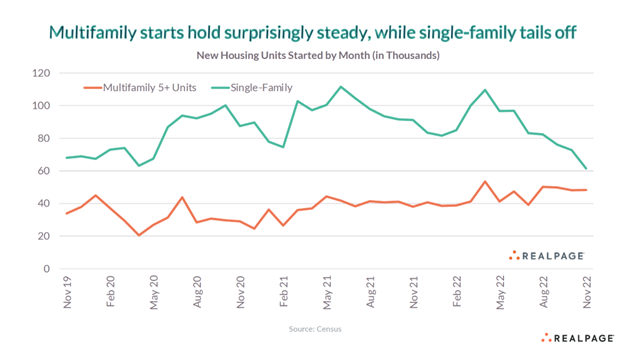

You can see from this chart that consumer sentiment has a significant impact on the apartment absorption rate. When people aren’t feeling secure or optimistic about the economy, their jobs, or the future in general, they are less likely to make the commitment to move, even when there is a significant need to do so.

You can see from this chart that consumer sentiment has a significant impact on the apartment absorption rate. When people aren’t feeling secure or optimistic about the economy, their jobs, or the future in general, they are less likely to make the commitment to move, even when there is a significant need to do so.

What Can We Expect

This is not the first near-recession cycle we’ve seen. Real estate recessions have occurred throughout history: 1890, 1907, 1920, 1930, 1937, 1945, 1960, 1973, 1980, 1987, 1991, 2001, and 2008. It’s why you may hear things like, “We’re due for a recession,” on CNBC.

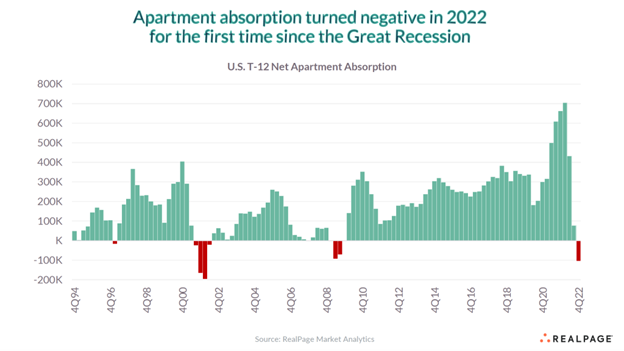

As you can see from this chart, it’s not the downturn we should focus on, but the years that follow a downturn. Negative apartment absorption in 2001 and 2008 was followed by a period of long-term growth upwards over six years after 2001 and for 13 years following 2008.

As you can see from this chart, it’s not the downturn we should focus on, but the years that follow a downturn. Negative apartment absorption in 2001 and 2008 was followed by a period of long-term growth upwards over six years after 2001 and for 13 years following 2008.

As commercial lenders pull back, and as domestic and foreign investors – including high net-worth individuals – zip up their pocketbooks, there will be developers who can’t raise the capital needed for necessary capital improvements. Others who rushed into investments in 2020 and 2021, and did not purchase well, won’t be able to meet their maturing loan costs. The investors who had no choice but to finance with high-levered floating-rate debt and limited-life cap interest rates will have a difficult choice to make – sell or seek capital investment from a cash-in refinance (which may require vis-a-vis preferred equity or mezzanine), or take on additional partners in the form of JV equity.

We also expect to see medium and large fund investors sell off as certain funds near the end of their life. They’re in a position to sell because although the returns won’t hit the high marks of 2020 – early 2022, they’re still achieving their target returns.

The first wave of distressed sales will provide discovery as to the current pricing and real estate market value.

As we’ve seen in the past, some projects will move into abandonment and foreclosure and present a unique opportunity for confident, disciplined, and patient capital. As strategic buyers, we will wait for transactions to hit the market at the bottom-out pricing level, which will set the market precedent for pricing and cap rates.

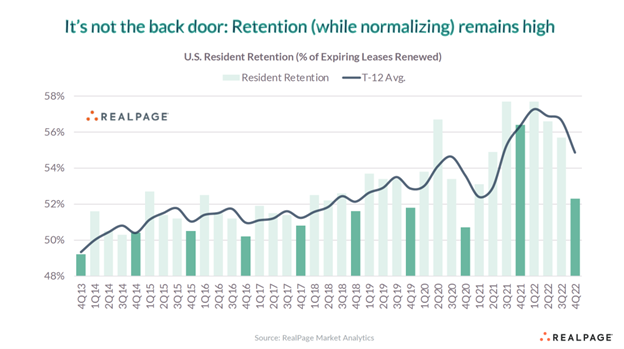

We see a similar pattern with lease retention. Historically, fourth quarters see a dip in lease retention, but are followed by higher rates. According to RealPage Market Analytics, overall, lease retention remains high.

We see a similar pattern with lease retention. Historically, fourth quarters see a dip in lease retention, but are followed by higher rates. According to RealPage Market Analytics, overall, lease retention remains high.

A Time For Relationship-Building

Historically, it is during this downturn when CGI+ finds the deals with the best ROI. Sometimes they are messy projects in need of improvement and repair. Since we know this, we spend time building relationships with the right general contractors and the best construction teams who will be able to get the job done well, fast, and at the right price. It is not unrealistic to have construction contracts in place by the time we reach the signing table.

A Time For Building Our Team

Simultaneously, this real estate cycle presents a great opportunity to hire some of the best workers and property management teams. With recent layoffs, top talent in America is panicking and unsure of what the next move is. It affords us leverage to fill roles that will be some of the most important in the coming months and years.

Long-term Trends for Multifamily

Looking at the long-term over five years, 10 years, and beyond, the trend is still bullish on multifamily and industrial. Wealth management firms have disclosed the launch of dedicated multifamily and industrial funds.

Demand is still solid for our product types – high-end luxury lifestyle, rental communities. The trend of the mid-20th century towards sprawling suburban, expensive, and high-maintenance homes is slowly being matched by a growing desire for maintenance-free vertical communities.

Demand is still solid for our product types – high-end luxury lifestyle, rental communities. The trend of the mid-20th century towards sprawling suburban, expensive, and high-maintenance homes is slowly being matched by a growing desire for maintenance-free vertical communities.

We’ve also seen evidence of stability in grocery-anchored and mixed-use retail. Historically, retail of this type is resilient. Our retail focus tends to be mixed-use. Even during the height of the pandemic, this product type stayed strong and we predict an upswing.

CGI+ Positioning

Our portfolio is primarily financed with fixed-rate, long-term debt with limited maturities in the near term. We aim to maintain an investment holding so that we can buy at an attractive basis as the first wave of deals comes to market.

Investors with problems in their existing portfolios are in a tough position. They will be busy managing their existing portfolio and cash needs without any leverage to grow their portfolios.

In Conclusion

Keep in mind that real estate is most often bullish, strong, and resilient in the long run, even when the short term is bumpy or bearish. When you are invested in quality products, as CGI+ and our investment partners are, our key power point is in our ability to stand still.

Keep in mind that real estate is most often bullish, strong, and resilient in the long run, even when the short term is bumpy or bearish. When you are invested in quality products, as CGI+ and our investment partners are, our key power point is in our ability to stand still.

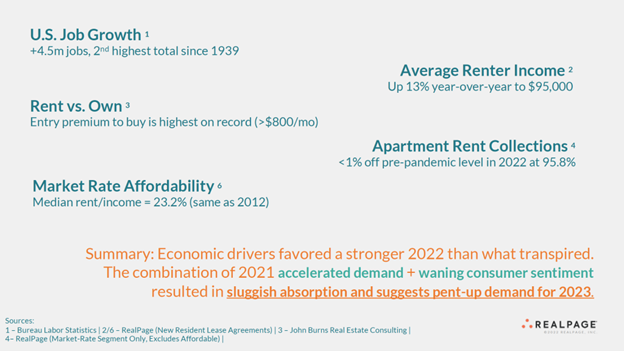

Economic drivers that we’ve seen hold the key to reversing a housing crisis are stronger than the market indicators of 2022 suggest. This suggests that there will be increased demand in the coming quarters and years.