The commercial real estate market is heavily influenced by the state of the overall economy. During periods of economic growth, demand for commercial real estate typically increases, which can drive up prices and lead to new construction. Conversely, during economic downturns, demand for commercial real estate tends to decrease, which can lead to falling prices and a slowdown in new construction.

The commercial real estate market is heavily influenced by the state of the overall economy. During periods of economic growth, demand for commercial real estate typically increases, which can drive up prices and lead to new construction. Conversely, during economic downturns, demand for commercial real estate tends to decrease, which can lead to falling prices and a slowdown in new construction.

The Southeast US is home to a diverse set of economies and real estate market trends, with Florida, Georgia, North Carolina, and Texas being some of the most active states in terms of commercial real estate (CRE). Depending on the specific state and region, the commercial real estate market can be affected by different factors. For example, markets that are heavily dependent on tourism may be more affected by changes in travel and tourism trends than markets that are more focused on other industries.

The state of the economy, as well as a number of other factors such as interest rates, demographic trends, and government regulations, all have an impact on the commercial real estate market. It is difficult to predict how these factors will evolve over time, and how they will ultimately affect the market.

CGI’s Southeast portfolio encompasses Orlando and Atlanta markets. We like these markets because they sit at the intersection of industry, job security, full time residents, and a strong tourism economy. Over the last three years, the population of both metropolitan cities grew, largely because they offer a high quality of life at a fraction of the cost of other states in the West, Midwest, and Northeast. While many areas in the US have struggled to stabilize the rising costs of housing, Atlanta and Orlando are at the forefront of providing affordable housing solutions.

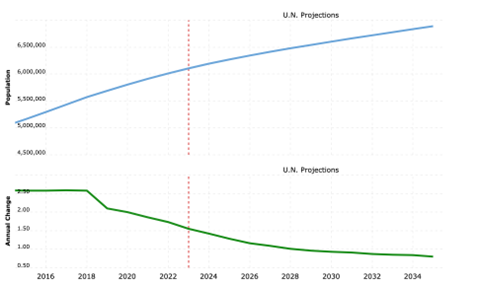

ATLANTA METRO AREA

Atlanta Metro Area Population Trends from 2015 to 2022, with projections to 2034, according to Macrotrends – The Premier Research Platform for Long Term Investors

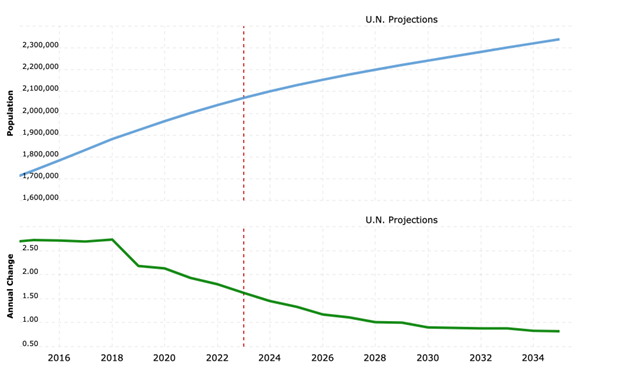

ORLANDO METRO AREA

Orlando Metro Area Population Trends from 2015 to 2022, with projections to 2034, according to Macrotrends – The Premier Research Platform for Long Term Investors

High prices, high borrowing costs, stiff competition, and economic volatility dissuaded many CRE players from investing and building heavily in 2022. The year 2023, however, can be the year real estate investments explode and favor the industry.

What to expect in 2023

In 2023, expect to see weak growth in various sectors, like energy production and consumption, brick and mortar retail, and manufacturing.

But according to Economist Intelligence, tourism is one industry expected to see a swift increase in profitability. “Global tourism will rise by 30% in 2023,” predicts the EIU Outlook, “following a 60% growth in 2022.”

Studies like this one by A. Cunha and J. Lobao, provide exponential evidence that tourism positively impacts the real estate industry in favor of commercial developers and investors. There are many reasons for this, but the big theme is that as more and more residential multifamily projects are converted to short-term rentals, supply for long-term rentals is squeezed creating more demand and average higher rental prices.

Additionally, towards the end of 2022, we saw an increase in rental market demand compared to homeownership due to inflation and loss of income, and a general sentiment of wanting to live better with less. In fact, Orlando was voted one of the strongest renter’s markets and one of the best places to buy rental property in 2022 by a report that analyzed US Census Bureau data. The report used a measurement of four key investment metrics:

- Cash Flow

- Affordable property pricing

- Population growth

- Job market

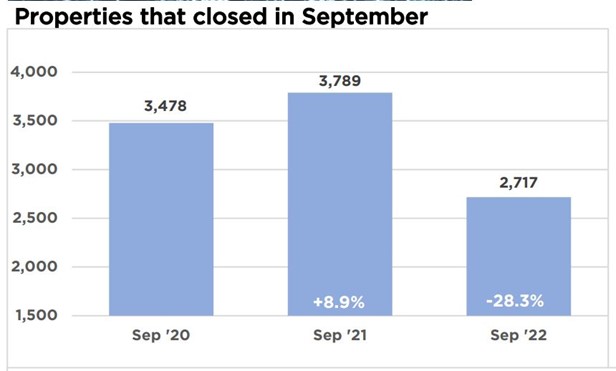

It is predicted that the trend will continue through 2023. Inversely proportionate, it is expected that single family residential purchases will fall through 2023. Rising interest rates in 2022 and increased construction costs will continue to price out many potential home buyers, hence a sharp decline in home acquisitions in 2023.

This chart by Orlando Regional REALTOR® Association provides evidence of a shrinking trend in residential home sales.

Final words

The COVID-19 Pandemic pushed people to rethink and critically look at their housing, lifestyle, and life in general with the diverse effects that were felt globally. Despite the expected challenges and predictions, the Southeast boasts mild climates, affordable living costs, and robust work opportunities, making it a preferred location for relocation. These factors have contributed to major municipalities of the region enjoying a thriving real estate market.