One Question with: Shlomi Ronen

What is your outlook for multifamily financing in 2021?

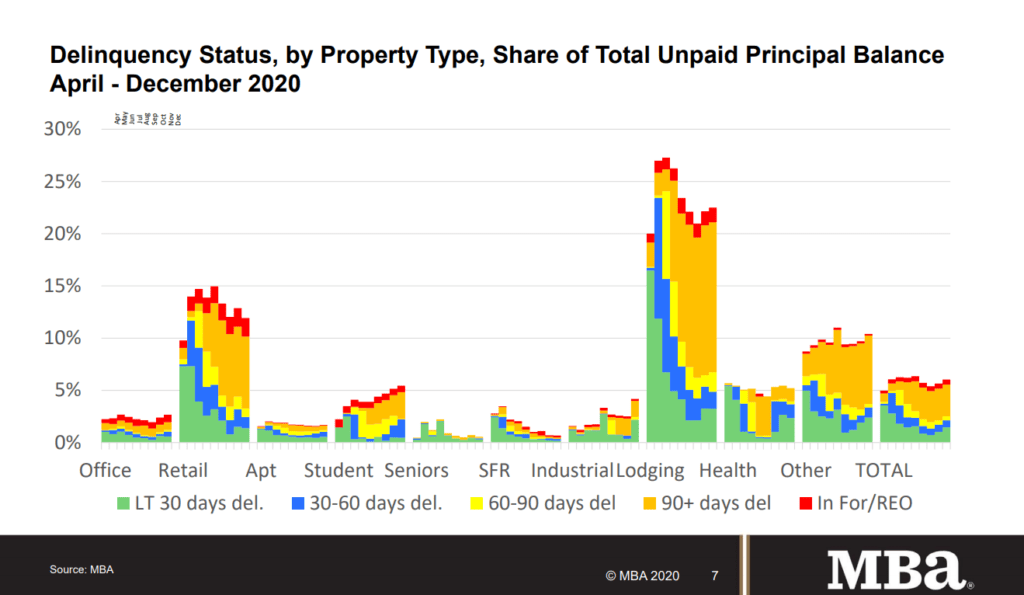

The outlook for multifamily financing in 2021 is strong. In 2020, the sector held up very well relative to other commercial sectors.

As a result, lenders, from banks to life companies, are allocating more capital to deploy in multifamily as they reduce their lending in retail, office and hotel. The agencies, FNMA and Freddie Mac, remain very active with less uncertainty about their future due to the Biden administration seemingly less focused on privatizing them as the Trump administration had been. Increased liquidity in the sector should result in further tightening of spreads and more aggressive loan terms. Of note – a trend that has continued to gain momentum in 2020, is the rise of debt funds in providing both bridge and, more recently, construction debt, to commercial real estate investors and developers. Providing both increased leverage, up to 85% in certain cases, and non-recourse debt at spreads that range from 3.25% to 5% over Libor Debt funds that have captured market share from the banks that used to dominate the bridge and construction loan space.

Shlomi Ronen is founder and managing principal of Dekel Capital, a Los Angeles-based real estate merchant bank. An adjunct professor at USC teaching a graduate course on Real Estate Capital Market, Shlomi is often sought out by real estate and business publications for his views on the real estate capital markets.

Shlomi Ronen is founder and managing principal of Dekel Capital, a Los Angeles-based real estate merchant bank. An adjunct professor at USC teaching a graduate course on Real Estate Capital Market, Shlomi is often sought out by real estate and business publications for his views on the real estate capital markets.