Through three quarters in 2021, 475,000 apartment units have been absorbed in the U.S., already topping 2018’s single year high of 370,000 recorded by Matrix. Demand has also been relentless. At least 100,000 units have been absorbed each of the last four quarters, which is also a first.

The absorption numbers explain the industry’s recent extraordinary rent performance. Asking rents nationally are up 11.4 percent year-over-year through September, while the occupancy rate of stabilized properties rose 110 basis points year-over-year to 95.9 percent as of August, per Matrix data of 144 markets.

Robust multifamily absorption is driven by a confluence of factors, including robust economic growth, the decline in unemployment, pent-up demand coming out of the pandemic, and strong household savings. Plus, there remains a long-term shortage of housing supply as new construction was stifled for several years coming out of the Great Recession, and single-family home prices have soared.

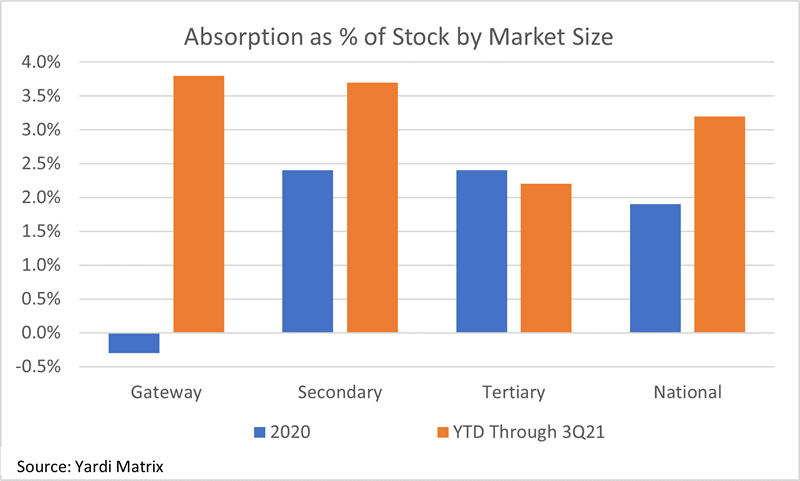

Arguably the most notable part of the 2021 landscape is the rebound in gateway markets, which are on the verge of a “worst-to-first” turnaround. Gateway metros (which Yardi defines as New York City, Boston, Washington D.C., Miami, Chicago, Los Angeles and San Francisco) combined posted negative (-7,000) absorption in 2020.

Arguably the most notable part of the 2021 landscape is the rebound in gateway markets, which are on the verge of a “worst-to-first” turnaround. Gateway metros (which Yardi defines as New York City, Boston, Washington D.C., Miami, Chicago, Los Angeles and San Francisco) combined posted negative (-7,000) absorption in 2020.

The exodus of renters during the first few quarters of the pandemic prompted questions about the long-term future of urban markets. Though doubts about the prospects of large urban submarkets remain far from resolved, data indicates that demand for apartments returned as cities reopened services and amenities in 2021.

Through three quarters in 2021, gateway metros have absorbed some 108,000 units. As a percentage of stock, that amounts to 3.8 percent, which is the highest rate among metros ranked by market size. Secondary markets absorbed 3.7 percent of stock, while tertiary metros trailed at 2.2 percent of stock. In 2020, gateway metro absorption was -0.3 percent compared to 1.9 percent for the entire U.S.

Los Angeles absorbed 15,900 units through 3Q21, or 3.6 percent of total stock, compared to a 1.1 percent absorption rate in 2020. New York, San Francisco and San Jose all had negative absorption in 2020 but strong growth through 3Q21.

During the pandemic, gateway markets lost some Millennial renters with children looking for housing with more space and/or better schools, renters who work remotely looking for lower-cost housing and those seeking a more suburban or rural lifestyle. Now units are being backfilled, largely by young workers seeking the experience of city life and downsizing retirees. Although office workers have been slow to return due to the Delta variant, residential sections of the gateway cities are returning to normal faster than business districts as recreation and entertainment opens back up.