Commercial real estate developments have been in a steady upswing in recent years, however, several things stand to threaten the industry’s acceleration.

In our weekly team meetings, we discuss important current events and how they affect all parts of the project life – due diligence, acquisition, planning and development, stabilization, and management or disposition.

Here are some of the world’s most pressing topics in Q4 2022 and how they’re shaping our industry and our portfolio.

Increase in construction costs (by over 30%)

We’re all aware of the looming supply chain issues of 2022. There are many causes leading to the breakdown, including the COVID pandemic lockdowns, which began in China long before other parts of the world and lasted long after other countries resumed BAU. The lack of transportation personnel to move materials from ports to retail locations has contributed to the breakdown. Geo-politics, especially the Russia-Ukraine War has also led to construction disruptions. Many developers do not have access to construction materials and supplies.

The result that we’re finding is about a 30% increase in the cost of construction, according to our analysis of J.P. Morgan Research.

Other fallouts from the pandemic include a shortage in construction labor force, high commodity and transportation costs, and general inflation. Where real estate consumers were on the move in 2020 and 2021, in 2022, many people are choosing to stay put and push out home purchases and construction projects to a later date.

The FED and Cap on Interest Rates

One of the biggest factors causing a slow-down in developments is the interest rate hikes of 2022. Interest rates determine how much developers have to pay to buy a property and they influence real estate value. Record low-interest rates from ‘20 – ‘22, bottomed-out at 0.25% to keep America’s economy pumping through a pandemic. After steady and not-so-slow rate increases, today’s current value of 4.00% is predicted by Trading Economics Forecast to rise again to 4.50% in December ‘22.

The Federal Reserve’s increase of interest rates over the last half of ‘22 has almost obliterated floating rate commercial real estate lending activity. Transaction volume is slowing down and current floating interest rates are on their way up. A managing Director at LA-based advisory Tauro Capital Advisors told Real Estate Capital USA back in June, “Today’s 0.75% rate hike by the Federal Reserve is sending a shockwave through the real estate capital markets. Several bridge and construction lenders have already communicated a halt on lending for the foreseeable future.”

Further rate hikes will bring difficulties in the housing market. More developers may become discouraged from entering the market or refinancing projects, while some are forced into foreclosure.

Construction projects have stopped (60% of them!)

We’re seeing that several factors, such as high land cost, have affected the construction industry’s progressive movement forward. In fact, according to Associated General Contractors of America, as early as in 2020, 60% of construction firms had canceled and/or delayed construction projects. At a time when physical jobs were unable to continue, we also saw new density restrictions and zoning laws all over the country, but especially in our acquisition zones.

We can report that the high cost of land, lack of inexpensive labor, and rising construction costs make it a tough time to start out in the real estate and development industry.

Getting Involved in Our Community

At CGI+, we make it a point to assimilate into communities where we develop. Over the last two years, there is much more community interest and involvement in what’s happening around town. Many city councils encourage community participation in the permitting process, which allows current residents to oppose new construction if those projects don’t fit into their vision for the community.

Realistically, this is why it’s important for CGI+ and our individual team members to become household names and regular contributors to these communities.

Our La Brea project is an excellent example of this. Heavy involvement in the community, including the recognition of homeowners goals gives us the edge. We make it our job to educate on why the new Purple Line station at Wilshire Boulevard and La Brea Avenue along with our La Brea Project is a good thing – these enhancements will transform underused areas, reduce crime, improve congregant homelessness, increase property values, and enrich to their personal lives and culture.

A Housing Shortage

Around the country, and in California and LA especially, we’re experiencing a housing shortage.

Yet, despite this, new developments are not breaking ground because of the issues we’ve been talking about – inflation, supply chain bottlenecks, and increased costs in construction materials.

The Los Angeles Times reported that one of the main causes of LA’s housing crisis is that Angelenos love their space. Single family homes are not built vertical, but are spread across an acre or more. Those who can not afford it are forced into overcrowded areas, LA Times reported.

CGI+ has tried to overcome this by blending the best of both worlds – vertical communities that offer green spaces, sprawling community areas, lots of natural light and gardens, as well as larger-than-average floor plans at LA-affordable prices.

MeasureULA – known as LA’s “Mansion Tax” – Has Passed

Measure ULA just passed, with 53.56% of voters agreeing to the bill. Measure ULA adds a levy on all property sales over $5M. It’s known as a documentary transfer tax equal to 4% on properties selling between $5M – $10M, and 5.5% on properties with sales prices over $10M. This tax is in addition to the existing 0.45% transfer tax representing a 1000% increase which will go into effect in April 2023. While the goal of the measure is to raise money for affordable housing, one of the side effects of the bill will be a massive reduction in housing production in the city. The new tax makes development in the city significantly more difficult to pencil and thus, will lead to meaningly less production in the years to come.

As owners of real estate in the city, a positive is that it will lead to higher than anticipated rent appreciation as existing product will not have to compete with significant new supply. With our LA portfolio, we are currently analyzing the go-forward returns of holding assets long-term to prioritize cash flow or sell prior to the measure going into effect. We will continue to provide you updates as more information comes out about the implementation of this measure.

Layoffs will affect rent prices.

As we move into ‘23, our research and data suggests that as the cost of doing business stays high or even creeps higher, it will trigger additional layoffs. Mass layoffs due to economic decline will rob hard workers of their income and livelihood. It will affect rent prices for homes with fewer people looking to buy and acquire houses. When we’ve seen this cycle in history, we learn that consumers will put off buying houses and opt to rent, creating more demand for rental properties. The layoffs give landlords a strong position to determine rental prices due to demand and to pick the best tenants for their properties.

Lenders are affected by inflation and supply chain breakdown, too.

We expect to see an increase in developer foreclosures. Construction business depends on lenders to finance projects. Developers are on time schedules and are expected to meet deadlines. The pandemic slowed down the real estate industry, causing massive construction loan defaults.

The rate of foreclosures for many projects that have defaulted on their payments is accelerating. With so many projects stalled and the rising cost of construction, some newer developers are not able to pay back banks and are choosing to walk away from half-finished projects. Driving through residential neighborhoods, we have seen so many stalled apartment building developments. Many have been stagnant for months – standing exposed to the elements with only framing and scaffolding in place.

By expecting these changes, we can get ahead of them and will be ready to act ahead of other developers. It’s a once-in-a-decade opportunity to close on discounted projects at a time when the rental market is strongest.

CGI+ has been at the forefront of these swings in the past – acquiring strategically placed projects under financial crisis, then rebranding, and specializing in value-add development before releasing them back to the market at a profit.

The Russia-Ukraine War affects investments and construction in America.

The Russian invasion of Ukraine has affected America’s real estate market by influencing consumer behavior changes. U.S. inflation has reached its highest point since 1981, which is causing potential homeowners to delay home purchasing decisions until a more stable economy can be seen. Their decisions are supported by the increase in the costs of necessities.

We’ve seen an increase in volatility in global equities markets across the board – stocks, indexes, futures, FOREX and cryptocurrencies. As mentioned before, the disruption in global supply chains has increased construction costs, affecting home prices. The Euro rate has fallen below parity with the USD due to high energy prices and European inflation. Europe depends heavily on Russia for oil and natural gas. This has brought currency impact on the European economy and on land and real estate investments in the US.

As a result of a weakened Euro, more investors are turning to America because it’s the strong currency. As a result, the real estate industry will experience new investors. Historically, stock volatility has encouraged investors to move their investments into real estate, which is sometimes seen as the safer investment stream.

Another point that affects homeowners and renters is the rising cost of gas, capitulated by the U.S. not accepting oil and gas from Russia to prevent supporting Putin’s regime attacks on Ukraine. Increased gas prices may cause tenants difficulties meeting their rent obligations because prices for all necessities and utilities are on the rise.

What’s Next

Here’s what we expect from the beginning of ‘23:

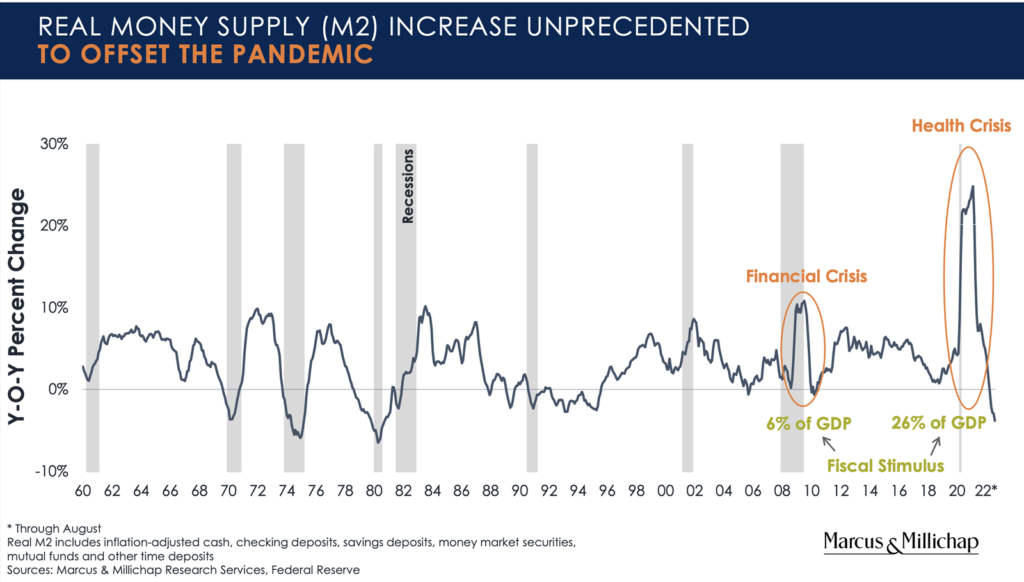

Real estate funds and REITs have built up massive amounts of dry powder by sitting on the sidelines due to uncertain pricing, land valuation changes, and the potential for abrupt strategy alterations. Specifically in the last two years, we’ve been seeing an unprecedented increase of real money supply (including inflation-adjusted cash, checking deposits, savings deposits, money market securities, among others), waiting to be invested (see Chart 1A below).

CHART 1A. REAL MONEY SUPPLY (M2) INCREASE UNPRECEDENTED

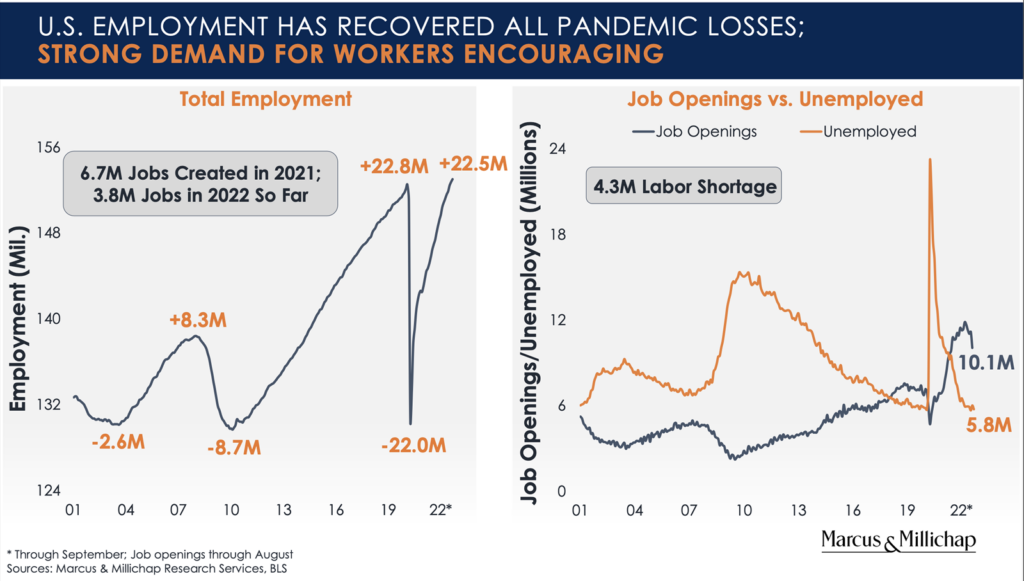

After the pandemic, many market factors were able to return to normal. For example, the U.S. employment rate was able to recover all pandemic losses, stabilize and generate an encouraging amount of job openings, surpassing the unemployment rate (see Chart 1B below).

CHART 1B. U.S. EMPLOYMENT HAS RECOVERED ALL PANDEMIC LOSSES

So, as pricing and supply & demand stabilize, consultants like PwC predict cash-heavy, low-leverage buying firms will make the first move off the sidelines.

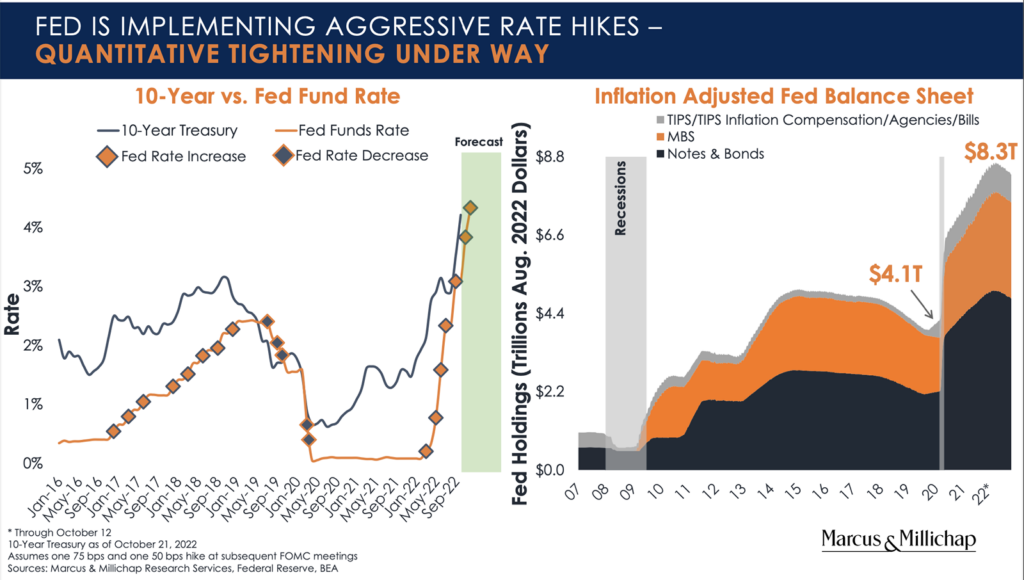

We expect to see more developers selling distressed assets or walking away and succumbing to foreclosure. In turn, lenders will look to lighten the burden of distressed and value-add assets off their books. In the past, this has presented a strong buying opportunity for CGI+. The Fed’s rate hike will balance the buyer’s market, which dominated in ‘22 (see Chart 1C below). However, there is a quantitative tightening under way.

CHART 1C. FED IS IMPLEMENTING AGGRESSIVE RATE HIKES

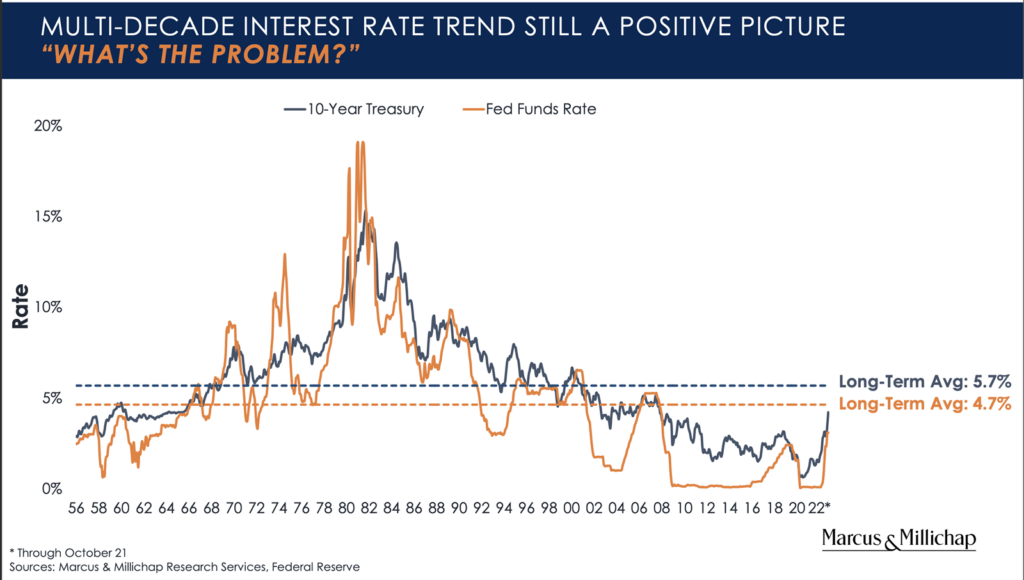

As sellers’ positions flatten, those who can afford to hold on to their properties will. We expect these sellers to lag after the market in ‘23 and ‘24. Even though the Fed rate hikes have seemed enormous in the last 12 months in comparison to their behavior between ‘09 and ‘17, and they’re higher than they were before 2008, it’s possible to conclude that the rate trend is still a positive picture. We’re well below the 10% and 20% peaks seen in the 80’s and on average, the decreasing tendency has been maintained (see Chart 1D below).

CHART 1D. MULTI-DECADE INTEREST RATE TREND STILL A POSITIVE PICTURE

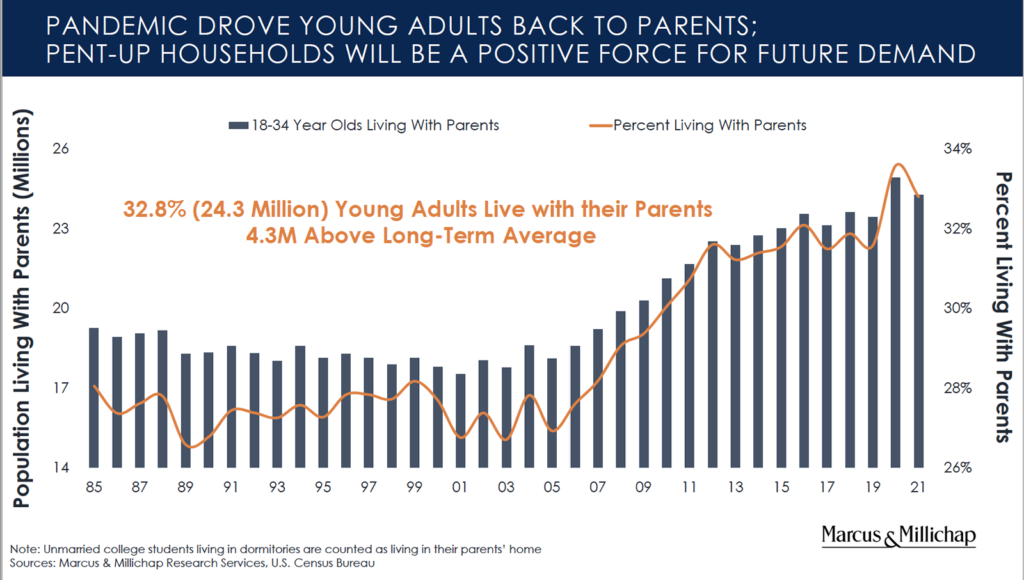

Marcus & Millichap Research Services share two very important points for our niche focus. Chart 1E below tells a story of young adults moving home during the Pandemic, essentially holding them back from starting their independent lives, and keeping potential empty nesters from enjoying their newfound freedom. Data suggests that the hold back force will be a propellant for future demand.

CHART 1E. PANDEMIC DROVE YOUNG ADULTS BACK TO PARENTS

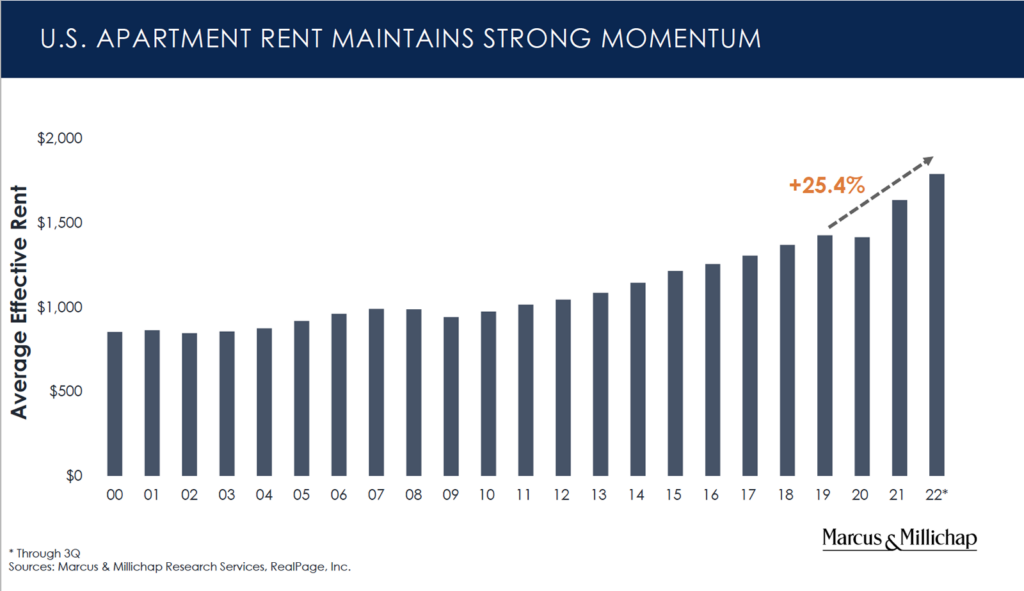

Visible in Chart 1F, we see that despite all the market challenges, apartment rentals remain in a strong upswing with an average effective rent growth of over 25% in the last two years.

CHART 1F. U.S. APARTMENT RENT MAINTAINS STRONG MOMENTUM

In 2021-2022, the general theme was that everybody wanted to get in on real estate investments and park their money in US land.

In 2023, institutional funds will be moving to the sidelines to wait and watch. As the euro and the dollar change positions, foreign equity is also likely to hold off.

Our general appetite will be cautious yet optimistic as we take a long-term approach to assets and new acquisitions.